resources

What is the ‘Transition to Retirement’ rule?

The Government’s ‘Transition to Retirement’ rule is designed to help Australians become more financially secure in the years leading up to their full retirement. The key to this rule is the access that pre-retirees aged over 55 now have to tax-advantaged account based pensions (ABP).

How can pre-retirees use the rule?

There are two main ways pre-retirees can benefit from the ‘Transition to Retirement’ rule:

- Use super to top up salary when moving to part-time employment

If you want to wind down your career by working part-time before you fully retire, the ‘Transition’ rule could enable you to top up your income using your super. Previously you had to ‘retire’ to access your super monies before 65 or age pension age. Now as long as you are over 55, you can start an ABP (with some restrictions until you retire) from your super money.

What are the tax advantages of Account Based Pensions?

An account based pension (ABP) is an investment which pays you a regular and tax effective income in retirement.

You invest money from a superannuation fund into an ABP.

The ABP then pays you a regular income comprised of interest and capital until your account runs out.

The annual income you choose must be at least equal to the Government’s prescribed minimum, based on your age and account balance.

The tax advantages of ABPs include:

o3 Lump sum tax is deferred when you transfer superannuation money to an ABP, and eliminated once you are aged 60.

o3 No tax on earnings in the fund.

o3 There are tax concessions on the income paid to you. In fact, once you are aged 60, income and withdrawals from an ABP are tax free.

You can use the ABP income (which has tax concessions) to replace your forgone salary – so your net income remains the same, but you are working less.

And, importantly, because you are moving to part-time employment, you won’t need to draw down as much of your super money as if you were fully retired.

- Top up your super without forfeiting net income

If you want to stay working full-time, but need to build up your super – or your spouse’s super – you can use the new rule to help you.

You can choose to sacrifice part of your salary so it is invested in your super fund (or your spouse’s super fund via the super splitting rules).

And, if you wish, you can start an ABP from age 55 to pay you income to make up part or all of the income you sacrificed… even though you are still working full-time. The benefit here is that salary sacrificing and ABP income are much more tax effective than paying PAYG tax on your full salary. (See case study below for an illustration of this strategy.) In addition, you can accumulate money in super and withdraw

it free of tax (as a lump sum in full or part, or as a pension) after age 60.

However, there is a limit on how much you can contribute to super on a tax deductible basis each year, and it is currently $25,000 if you are under age 60, and $35,000 if you are 60 and over.

Pre-Retiree’s Case Study: Combining ‘Transition’ rule with salary sacrifice strategy to build wealth tax effectively

Let’s say Mary is 55 and is currently earning $60,000 a year – which gives her $48,153 after tax. From this Mary invests $2,153 into super, leaving her with $46,000 p.a. to live on each year.

Mary currently has $300,000 in her super fund (all preserved). She enjoys her job and plans to keep working for another 10 years – but realises she needs to increase her superannuation balance at a faster rate.

One solution could be as follows:

- Transfer her super to an ABP under the ‘transition to

retirement’ rule

- Draw income of $13,329 p.a. from the ABP

- Salary sacrifice $19,450 p.a. to super from her gross

salary.

This should result in Mary having the same income to live on each year, made up of:

Salary (before tax & after super) | $40,550 | |

ABP income | $13,329 | |

Less tax | ($7,879) | |

Net Income | ||

$46,000 | ||

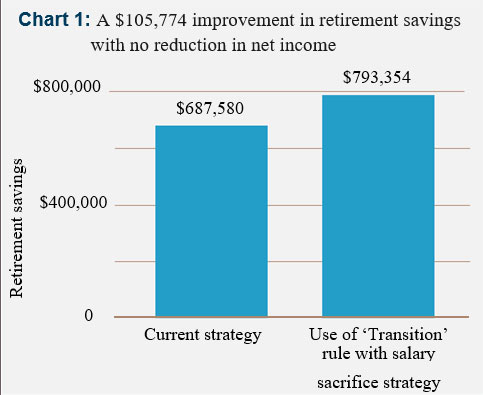

And, importantly, Mary will accumulate $105,774 more in retirement savings over the next ten years than if she had not adopted this strategy.

This improvement arises because of the additional contributions Mary makes to super as well as the tax efficiencies created by this strategy – and it has been done with no loss of net income.

Once Mary has reached age 60, her income from the ABP is completely tax free. She does not even have to include it in her tax return.

Note: Salary $60,000 p.a. gross. Mary already has $300,000 in retirement savings. Assumes ABP earns 8.0% p.a. gross and Super earns 6.8% p.a. We have used the 2013/14 income tax rates and thresholds. Both cases include Mary’s employer’s Super Guarantee contributions.

Who is Australian Unity Personal Financial Services?

We specialise in providing professional strategic advice to help you improve your current financial position and ultimately achieve your long term lifestyle goals.

Importantly, our initial advice isn’t a ‘set and forget’ service. Instead we offer you regular financial mentoring and ongoing guidance – in all aspects of your personal finances – to set you, and keep you, on the path to financial wellbeing.

Our team of experienced financial professionals can provide you with a detailed and totally tailored blueprint for financial success in any or all of the following areas:

- Financial advice

- Wealth creation

- Retirement planning

- Investments

- Superannuation

- Home loans

- Commercial loans

- Investment loans

- Equipment finance

- Car finance

- Personal estate planning

- Business estate planning

- Personal risk insurance

- Business risk insurance.

Australian Unity has a proud 170 year heritage of helping Australians create secure financial futures. This pedigree and experience, combined with our corporate strength and leading edge strategic advice capability, means we are uniquely placed to offer you high quality personal financial services… each finely tuned to your particular needs to ensure you achieve your vision of a secure financial future.

After all, your financial wellbeing is at the heart of everything we do.

Any advice in this document is general advice only and does not take into account the objectives, financial situation or needs of any particular person. You should obtain financial advice relevant to your circumstances before making investment decisions. Where a particular financial product is mentioned you should consider the Product Disclosure Statement before making any decisions in relation to the product. Whilst every care has been taken in the preparation of this information, Australian Unity Personal Financial Services Ltd does not guarantee the accuracy or completeness of the information. Australian Unity Personal Financial Services Ltd does not guarantee any particular outcome or future performance. Australian Unity Personal Financial Services Ltd is not a registered tax agent. If you intend to rely on any tax advice in this document you should seek advice from a registered tax agent. Australian Unity Personal Financial Services Ltd ABN 26 098 725 145, AFSL & Australian Credit Licence No. 234459, 114 Albert Road, South Melbourne, VIC 3205. This document produced in November 2013. © Copyright 2013.