Coronavirus And It's Impact On The Australian And Global Sharemarkets

- 360South

Recent volatility in financial markets

Over the past few days we have seen financial market volatility increase substantially in reaction to an increase in cases of Coronavirus disease outside of China. Investors have also become increasingly concerned following the disclosure that the Coronavirus is apparently communicable even by those who are not showing symptoms, making control of the outbreak that much more difficult for authorities globally. Falls in the past few days are due to the expectation of earnings downgrades due to changing consumer patterns, a slowdown in global trade and the impacts on global GDP due to the spreading of the virus.

Additionally, the magnitude of the financial impact is unknown and this “uncertainty” is what markets have started to price in.

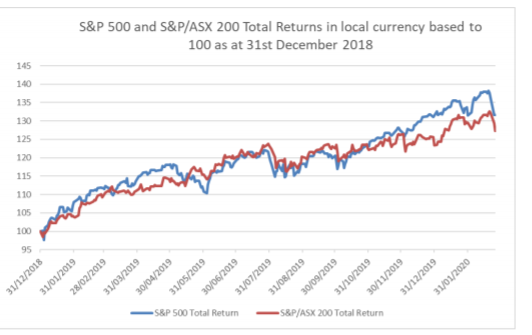

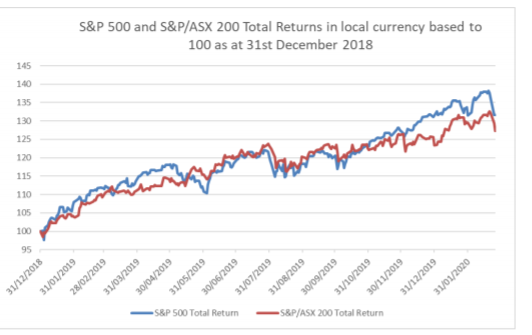

The market falls have largely erased gains in many stockmarkets in 2020. However, it is still important to keep perspective. In the graph below we can see the magnitude of the pull-back in the Australian and US stockmarkets when looking at gains since the end of 2018.

Since the beginning of 2020 the yield on the Australian 10-year bond has fallen from 1.37% p.a. to 0.93% p.a. at the time of writing. As investors chase safer assets, such as government bonds and the potential for monetary policy to be eased, bond yields could fall further depending on the magnitude of the virus.

In the graph below the sharp move lower in Australian and US 10-year bond yields is put into perspective looking at movements since the end of 2018.

At this stage, it appears it may take longer than originally anticipated to control the spread of the Coronavirus. As a result, we are likely to see several near-term impacts for financial markets.

Downgrades to economic growth. We are already seeing economists lower their global economic growth assumptions. Goldman Sachs lowered its economic growth expectations for the U.S. economy from 1.4% to 1.2% in the first quarter of 2020. This is a dramatic change in momentum from an economy that was growing at a rate of 2.1% during the final quarter of 2019. There have also been downgrades to global growth with China likely to see downgrades to growth assumptions with early indications of a 1.2% reduction to Chinese GDP growth likely to happen. Bond prices are rising (yields falling) in response to a more tepid global growth environment with bond yields globally moving lower.

Earnings downgrades. Several companies both domestically and internationally have warned of a negative impact to earnings in recent weeks. Most notable has been Apple; the global effects of Coronavirus are having a material impact on the company and as a result the company does not expect to meet its own revenue guidance for the second quarter of 2020. Worldwide iPhone supply will be temporarily constrained. In addition, store closures and reduced retail traffic in China are likely to negatively impact earnings for the company.

Central bank response to the slowdown. Because of lower expectations for global economic growth, investors will increase their expectations that central banks globally may provide further stimulus via lowering official rates and/or further quantitative easing. The prospect of additional stimulus and lower official cash rates in many countries may further stimulate demand for financial assets and drive prices even higher in the medium term – lower official cash rates have a positive impact on other asset class valuations assuming all things being equal. However, this is contingent on the Coronavirus being “under control”.

Control of the virus would include a dramatic slowing of new cases and a vaccine being developed to treat those who are confirmed cases. It is also contingent on the risk appetite of investors returning to levels pre the outbreak of the virus.

Conclusion

Whilst we appreciate events can have a long-term effect on investment markets our investment philosophy helps us to look through the noise and focus on expected 10-year asset class returns. If investment markets fall further on the back of earnings downgrades and a global slow down, we would expect that central banks will stimulate the economies. Thus, we may see that investment opportunities present themselves at which time we would then look to adjust portfolios to take advantage of mispriced assets that have the potential to outperform other assets over the medium to long term. It is important to put the volatile movements in financial markets over the past few days into perspective.

From the beginning of 2020 stockmarkets were up as much as 6-7% from the start of the year despite early news about the outbreak of the Coronavirus and investors initially chose to “look through” any negative consequences of the outbreak. What we are in the midst of is ostensibly a “re-pricing’ of the risks associated with the Coronavirus.

A combination of complacency, large pools of money looking for positive returns and positive sentiment at the start of 2020 (combined with changes to asset allocation and investment patterns that typically occur at the start of a new calendar year) have arguably seen investors ignore risks-somewhat at their peril. It is difficult to assess the overall impact of the Coronavirus on the global economy and financial markets longer term. However, it is safe to say that supply chains for many companies are now truly globally and we are likely to see further disclosure by companies impacted in the near term. Travel restrictions, shipping interruptions, inventory dislocation and more cautious consumers will all have an impact on trade in the near term. Longer term it remains to be seen how long it will take for the global economy to return to normal. We remain vigilant to changing circumstances and the impacts of those changes on asset valuations.

What is Coronavirus?

“Coronaviruses (CoV) are a large family of viruses that cause illness ranging from the common cold to more severe

diseases such as Middle East Respiratory Syndrome (MERS-CoV) and Severe Acute Respiratory Syndrom (SARSCoV). A novel coronavirus (nCoV) is a new strain that has not been previously identified in humans.

Coronaviruses are zoonotic, meaning they are transmitted between animals and people. Detailed investigations found that SARS-CoV was transmitted from civet cats to humans and MERS-CoV from dromedary camels to humans. Several known coronaviruses are circulating in animals that have not yet infected humans.

Common signs of infection include respiratory symptoms, fever, cough, shortness of breath and breathing difficulties. In more severe cases, infection can cause pneumonia, severe acute respiratory syndrome, kidney failure and even death.

Standard recommendations to prevent infection include regular hand washing, covering mouth and nose when coughing and sneezing, thoroughly cooking meat and eggs. Avoid close contact with anyone showing symptoms of respiratory illness such as coughing and sneezing.”1

On 11th February 2020 the World Health Organization announced the official name would be COVID-19, a shortened version of coronavirus disease 2019. The World Health Organization refers to the specific virus that causes this disease as the COVID-19 virus.

1 WORLD HEALTH ORGANIZATION WEBSITE WWW.WHO.IT/HEALTH-TOPICS/CORONAVIRUS

Update on Coronavirus disease (COVID-19)

An update by the World Health Organization released 25 February 2020 has the number of cases of COVID-19 at 80,239 with 77,780 within China. Deaths from COVID-19 have now reached 2,666 people within China and 34 people outside of China2. Of concern has been the increase in cases outside of China with confirmed cases in the Republic of Korea now at 977, confirmed cases in Italy now at 229 and Japanese known cases now at 157.

2CORONAVIRUS DISEASE 2019 (COVID-19) SITUATION REPORT-36 – WORLD HEALTH ORGANIZATION